The Future of AI in Stock Trading: AI's Role in Transforming Stock Markets

April 10, 2025

The world of finance is currently undergoing a significant transformation, largely driven by advancements in technology. Looking ahead, it’s evident that artificial intelligence will play a pivotal role in stock trading, taking on the bulk of decision-making tasks. With the ability to process information swiftly and accurately, computers will operate with a level of intelligence. Essentially, AI acts as a super-smart robot, capable of analyzing xvast amounts of data rapidly and determining the optimal actions to take in the stock market.

As we move forward, AI will persist in altering the dynamics of stock trading. It will simplify trading processes, enhance predictability, and add an element of enjoyment. Through the utilization of AI, traders will gain clearer insights into market trends, facilitating improved decision-making based on data analysis. It’s akin to having access to a crystal ball, providing foresight into market movements and guiding traders towards more informed choices.

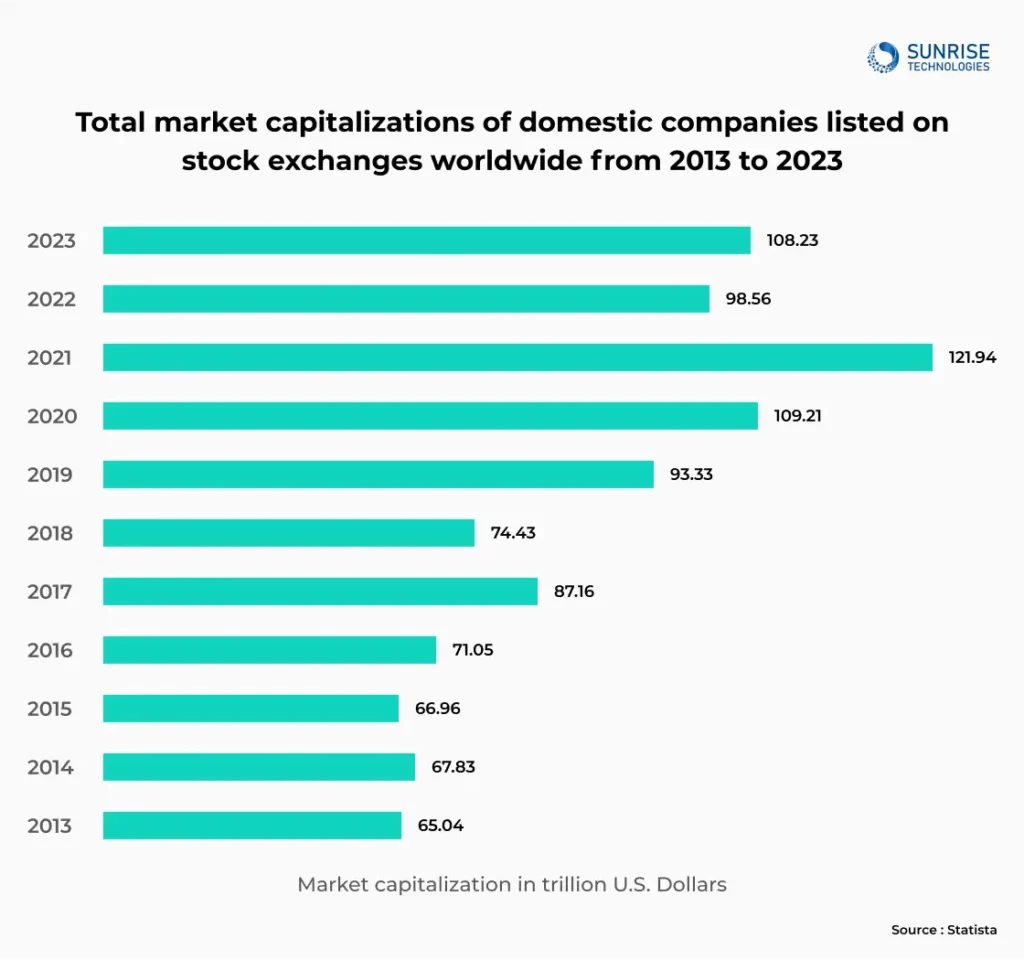

According to the stats, in 2022, the total value of the world’s domestic equity market was $95 trillion. By April of 2023, the market capitalization of the domestic equity market had surpassed $100 trillion. However, it’s important to remember that this figure only represents one part of the broad spectrum of financial markets available.

In this article, we dive deep into the world of artificial intelligence (AI) in stock trading. We discuss the pros and cons of integrating AI into stock trading, from demystifying complicated technicalities to providing actionable advice for novice traders. We explain the landscape of AI trading with clarity and transparency.

Before Delving into the Blog, let's First Understand What AI in Stock Trading in Detail

AI trading, also referred as algorithmic trading, is a technique of executing trades in financial markets using computer algorithms. These algorithms scrutinize extensive data sets, encompassing historical price movements, market trends, and economic indicators, to discern patterns and execute trading decisions. The adoption of AI in trading has been steadily gaining momentum in the industry, primarily due to its capability to swiftly and accurately analyze vast data sets, enabling it to recognize patterns at a pace surpassing human capacity.

The evolution of AI trading has been remarkable, particularly with the advancement of machine learning algorithms. This evolution has empowered traders to make more informed decisions by swiftly and precisely analyzing extensive data. Moreover, AI has facilitated the automation of trading strategies for some traders, granting them the opportunity to capitalize on market openings round the clock. As AI continues to shape the landscape of trading, its potential for transforming financial markets remains limitless.

Artificial Intelligence's Role in Stock Trading Transformation

The integration of AI into stock trading has unlocked the power of high-performance computing combined with intelligent decision-making powered by massive data sets, providing unprecedented opportunities to maximize trade margins at faster speeds than ever before. In the ever-changing world of global stock markets where time is of the essence for both traders and investors AI in trading whether sophisticated platforms or easy-to-use stock trading apps has proven to be a game-changer in unlocking opportunities while effectively mitigating risks.

In addition, financial companies will benefit greatly from the insights generated by AI-driven trading, gaining access to complex trading opportunities and making real-time buy and sell decisions by continuously analyzing stock prices and processing large volumes of unstructured information. This symbiotic combination of technology and finance is ushering in a new era of efficient and profitable stock trading that promises transformative results for market participants of all stripes.

Real world Example – How Trade Idea Use AI Technology to Leverage Stock Trading

Trade Ideas is a stock market tool that leverages artificial intelligence (AI) and machine learning (ML) algorithms to assist traders in generating trading ideas and making informed decisions.

Top Features

- Data Collection and Analysis: Trade Ideas collects vast amounts of market data in real-time from various sources such as stock exchanges, news outlets, social media, and financial websites. This data includes stock prices, trading volume, news sentiment, technical indicators, and more.

- Pattern Recognition: AI algorithms within Trade Ideas analyze historical market data to identify patterns and trends. These patterns could include price movements, trading volume, correlations between different assets, and other market dynamics.

- Machine Learning Models: Trade Ideas employs machine learning models to continuously learn from past trading data and refine its strategies. These models can adapt to changing market conditions and improve their accuracy over time.

- Strategy Generation: Based on the analysis of market data and patterns, Trade Ideas generates trading strategies and ideas. These strategies could include momentum trading, mean reversion, breakout trading, and others, tailored to individual trader preferences and risk tolerances.

- Backtesting and Optimization: Before deploying a trading strategy in the live market, Trade Ideas allows users to backtest their strategies using historical data. This helps traders assess the performance of their strategies under different market conditions and optimize them for better results.

- Real-time Alerts: Trade Ideas provides real-time alerts and notifications to traders based on predefined criteria or trading signals generated by its AI algorithms. These alerts help traders stay informed about market developments and potential trading opportunities. Overall, Trade Ideas combines AI and machine learning techniques to provide traders with data-driven insights, trading strategies, and real-time alerts to enhance their decision-making process in the stock market.

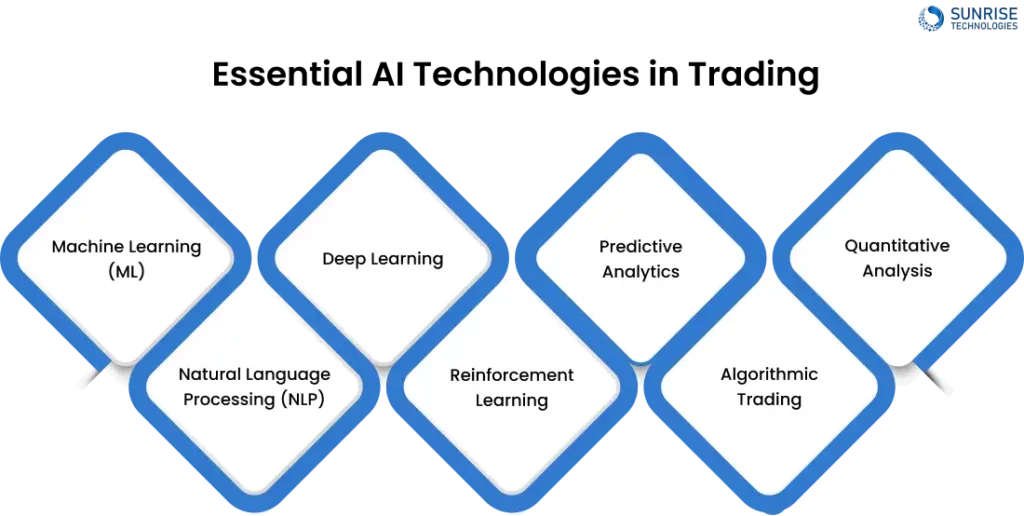

Exploring the Essential AI Technologies in Trading

In trading, Artificial Intelligence (AI) technologies play a pivotal role in enhancing decision-making processes, optimizing strategies, and mitigating risks. Some key AI technologies utilized in trading include:

- 1. Machine Learning (ML): ML algorithms analyze historical data to identify patterns and trends, enabling traders to make predictive decisions. ML models can adapt and improve over time, refining trading strategies based on market dynamics.

- 2. Natural Language Processing (NLP): NLP techniques process and analyze large volumes of textual data from news articles, social media, and financial reports to extract insights relevant to trading decisions. Sentiment analysis, a subset of NLP, gauges market sentiment to anticipate price movements.

- 3. Deep Learning: Deep Learning algorithms, a subset of ML, utilize neural networks to process vast datasets and identify complex patterns. They are particularly effective in image recognition, voice recognition, and sequential data analysis, offering valuable insights for trading strategies.

- 4. Reinforcement Learning: Reinforcement Learning algorithms learn through trial and error by interacting with a trading environment. They optimize trading strategies by maximizing rewards and minimizing risks, adapting to changing market conditions in real-time.

- 5. Predictive Analytics: Predictive Analytics leverages statistical techniques and AI algorithms to forecast future market movements based on historical data and current trends. These forecasts help traders anticipate price changes and adjust their positions accordingly.

- 6. Algorithmic Trading: Algorithmic Trading involves the automation of trading strategies using AI technologies. AI-powered algorithms execute trades at optimal times, prices, and quantities, eliminating human biases and emotions from the decision-making process.

- 7. Quantitative Analysis: Quantitative Analysis combines mathematical and statistical techniques with AI to evaluate trading strategies, assess risk exposure, and optimize portfolio performance. AI models enhance the accuracy and efficiency of quantitative analysis methods.

By leveraging these AI technologies, traders can gain a competitive edge in financial markets, capitalize on opportunities, and navigate volatility with greater precision and confidence. However, it’s essential to integrate AI technologies thoughtfully, considering factors such as data quality, model transparency, and regulatory compliance to ensure effective and ethical use in trading practices.

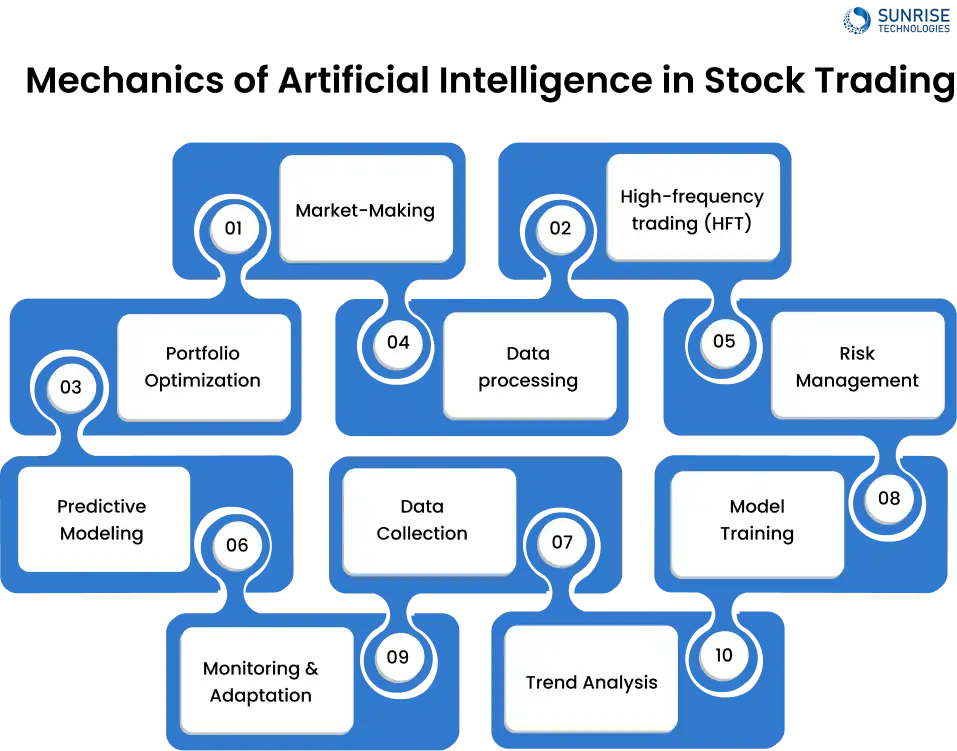

Understanding the Mechanics of Artificial Intelligence in Stock Trading and its Strategies

Artificial intelligence (AI) is a game-changer in the stock market. It provides investors with unprecedented access to massive amounts of financial information for making informed decisions. This game-changer not only helps investors gain deeper insights but also improves the accuracy of their investment strategies. Let’s explore some of the key AI trading strategies that drive this dynamic change.

- 1. Market-Making: Market making is the process of continuously quoting bid and offering prices for securities in order to provide liquidity to the market. AI algorithms are used to analyze the market data in real-time and adjust the bid-ask spreads to create a fair and orderly trading environment.

- 2. High-frequency trading (HFT): HFT uses advanced artificial intelligence (AI) to carry out high-frequency trades, often in fractions of a second. HFT algorithms analyze market information and carry out high-volume trades automatically, taking advantage of small price differences between different markets or stocks.

- 3. Portfolio Optimization: Portfolio optimization involves constructing and rebalancing investment portfolios to achieve specific objectives, such as maximizing returns or minimizing risks. AI algorithms analyze historical market data and investor preferences to allocate assets optimally across different securities.

- 4. Data processing: Data preprocessing is the process by which raw financial data is cleaned, filtered, and transformed to improve the quality and usability of the data. AI algorithms are used to deal with missing values, outliers, and to scale the data accordingly. Data preprocessing ensures that only the most relevant and reliable data are used for analysis.

- 5. Risk Management: The goal of risk management strategies in AI based stock trading is to identify, evaluate, and reduce the financial risks involved in trading. AI algorithms analyze the market and portfolio data to calculate various risk metrics, including volatility, drawdowns and Value at risk (VaR).

- 6. Predictive Modeling: Predictive modeling involves building AI models that forecast future stock prices and market movements based on historical data and market trends. These models utilize machine learning algorithms, such as regression, time series analysis, and deep learning, to identify patterns and relationships in the data.

- 7. Data Collection: Data collection is a fundamental aspect of AI-based stock trading, involving gathering diverse sources of financial data, including market prices, company reports, economic indicators, and news articles. AI algorithms are employed to collect, process, and organize large volumes of data from multiple sources efficiently.

- 8. Model Training: Model training involves developing and refining AI models using historical market data to optimize their predictive performance. AI algorithms, such as machine learning and deep learning, are trained on large datasets to learn patterns and relationships in the data.

- 9. Monitoring & Adaptation: Monitoring and adaptation strategies in AI-based stock trading involves continuously evaluating the performance of AI models and trading strategies in real-time. AI algorithms analyze market data and portfolio positions to assess the effectiveness of trading decisions and identify areas for improvement.

- 10. Trend Analysis: Trend analysis involves identifying and analyzing patterns in historical market data to forecast future market trends and price movements. AI algorithms utilize statistical techniques, time series analysis, and machine learning models to detect trends and patterns in the data.

10 Advantages of Artificial Intelligence in Stock Trading

Exploring the myriad advantages of integrating AI in the stock market, let’s lookout each in detail

- 1. Enhanced Decision-Making: With the integration of AI algorithms into stock trading, traders are empowered to make decisions that are not only more informed but also deeply rooted in data-driven insights. Unlike traditional methods that often rely on human intuition and subjective judgments.

- 2. Increased Efficiency: brings forth a significant boost in operational efficiency by automating various trading processes. Through AI-driven automation, tasks that were once time-consuming and labor-intensive can now be executed with unparalleled speed and precision.

- 3. Improved Predictive Analytics: Through the utilization of AI models, traders gain access to advanced predictive analytics capabilities that analyze extensive historical data sets. These AI-driven models can identify intricate patterns and correlations within the data, enabling them to forecast future market trends.

- 4. Reduced Emotional Bias: Mitigating emotional biases inherent in human decision-making processes. Unlike human traders who may succumb to fear, greed, or other emotional factors, AI algorithms operate based on objective analysis of data. By eliminating emotional biases, AI-driven trading strategies promote more rational and disciplined decision-making.

- 5. Real-time Market Monitoring: AI systems provide traders with the capability to monitor market conditions and news events in real-time, allowing for swift responses to changing market dynamics. By continuously analyzing incoming data streams, AI algorithms can detect significant market movements, news releases, and other events that may impact trading decisions.

- 6. Backtesting Capabilities: AI models offer robust backtesting capabilities, enabling traders to evaluate the performance of their trading strategies under various market conditions. By simulating trades on historical data, traders can assess the effectiveness of their strategies and identify areas for improvement.

- 7. Diversification Opportunities: AI-driven trading systems possess the ability to identify and capitalize on diverse investment opportunities across different asset classes and markets. Through sophisticated algorithms, AI models can analyze market trends and correlations, identifying potential opportunities for diversification and risk management.

- 8. Lower Costs: Automation of trading processes through AI leads to lower transaction costs, reduced spreads, and overall cost savings for traders. By eliminating manual intervention and streamlining trading operations, AI-driven systems minimize operational overheads and optimize resource utilization.

- 9. Improved Trade Execution: AI algorithms optimize trade execution by minimizing slippage and reducing market impact, leading to better trade outcomes. By analyzing market conditions and order book dynamics in real-time, AI-driven systems can execute trades at optimal prices and quantities, maximizing trading efficiency and profitability.

- 10. Regulatory Compliance: AI-based trading systems help ensure compliance with regulatory requirements by automating compliance checks and monitoring trading activities for potential violations. By analyzing trade data and market transactions, AI algorithms can detect suspicious activities and alert traders.

Drawbacks of AI in Stock Marketing

- 1. Algorithmic Complexity: AI-driven trading strategies can be highly complex and difficult to understand, especially for non-technical traders. Complexity can lead to challenges in implementation, maintenance, and monitoring of AI algorithms.

- 2. Lack of Interpretability: Some AI models, particularly deep learning algorithms, lack interpretability, making it difficult for traders to understand the reasoning behind their predictions. This can lead to mistrust and uncertainty among traders and investors.

How to Overcome these Drawbacks

By simplifying algorithmic complexity and enhancing interpretability, traders can overcome barriers to adoption and build trust in AI-driven trading strategies. This, in turn, can lead to more effective implementation, better decision-making, and ultimately, improved trading outcomes.

Difference Between Human vs AI in Stock Trading

Future of Artificial Intelligence in Stock Market

The future of artificial intelligence (AI) in the stock market holds immense promise, revolutionizing the way investors make decisions and manage portfolios. AI-driven algorithms can analyze vast amounts of financial data at speeds far beyond human capability, enabling more accurate predictions of market trends, price movements, and investment opportunities. Machine learning techniques allow AI models to continuously learn from new data, refining their strategies and adapting to changing market conditions in real-time. This dynamic approach to investing can provide investors with valuable insights, helping them identify profitable trades, mitigate risks, and optimize portfolio performance.

As we look forward to trading in the future, it’s clear that AI is at the forefront of changing the stock market as we know it. With its power to analyze data, forecast market trends, and optimise trading strategies, AI has the potential to change the way we trade in stocks. As the leading AI development company, we’re committed to helping the financial industry harness the power of AI.

With our partnership, financial institutions benefit from cutting-edge AI technology that improves decision-making, simplifies operations, and increases profitability. By harnessing AI’s transformative power, we not only shape the future of trading in the stock market. Let’s join Sunrise Technologies on a journey to a future where AI’s role in changing stock markets isn’t just a possibility; it’s a reality.

Sam is a chartered professional engineer with over 15 years of extensive experience in the software technology space. Over the years, Sam has held the position of Chief Technology Consultant for tech companies both in Australia and abroad before establishing his own software consulting firm in Sydney, Australia. In his current role, he manages a large team of developers and engineers across Australia and internationally, dedicated to delivering the best in software technology.