How To Select the Best Compliance Management Software for financial services

Mar 03, 2025

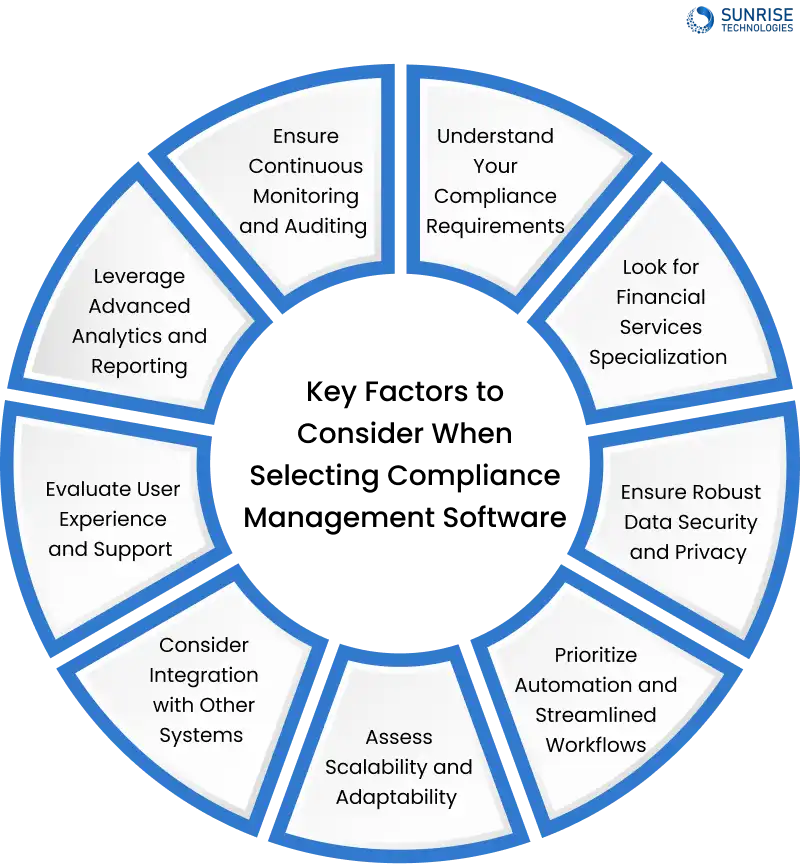

Selecting the right compliance management software is crucial for financial services firms to streamline compliance processes, mitigate risks, and stay ahead of evolving regulatory requirements. With numerous options available in the market, it can be challenging to choose the best solution that meets your specific needs. In this article, we will guide you through the key factors to consider when selecting compliance management software for your financial services organization.

1. Understand Your Compliance Requirements

The first step in selecting financial compliance software is to thoroughly understand your organization’s compliance requirements. Identify the specific regulations and standards that apply to your business, such as FINRA, FDIC, CFPB, and GLBA. Assess your current compliance processes, identify pain points, and determine the features and functionalities you need to address them effectively, leveraging financial compliance software tailored for financial services.

See how GRC software can streamline audits, risk assessments, and compliance in real time. Book a FREE demo tailored to your industry.

2. Look for Financial Services Specialization

When evaluating compliance software for financial services, prioritize solutions that specialize in the financial services industry. These platforms are designed to handle the unique compliance challenges faced by banks, credit unions, investment firms, and insurance companies. They often come pre-configured with templates, workflows, and reporting specific to financial services regulations, making them ideal choices for financial compliance management software.

3. Ensure Robust Data Security and Privacy

Financial services firms handle sensitive customer data and are subject to strict data security and privacy regulations like GLBA and CCPA. When selecting financial compliance management software, make sure it offers robust data security features such as encryption, access controls, and audit trails. The platform should also be regularly updated to address emerging security threats and comply with evolving data privacy laws, ensuring the highest level of security in financial software development.

4. Prioritize Automation and Streamlined Workflows

Manual compliance processes are time-consuming, error-prone, and inefficient. Look for financial compliance software that automates repetitive tasks such as data collection, analysis, and reporting. The platform should streamline workflows across different departments and functions within your financial institution, ensuring real-time monitoring of regulatory changes, compliance status, and risk indicators, optimizing financial compliance management software for seamless operations in financial services.

5. Assess Scalability and Adaptability

The compliance landscape is constantly evolving, with new regulations and standards being introduced regularly. Choose a financial compliance software vendor that has a deep understanding of the financial services industry and a proven track record of adapting their solutions to meet changing requirements. The platform should be scalable to accommodate your organization’s growth and changing needs, reflecting the agility required in financial software development for compliance management.

6. Consider Integration with Other Systems

To maximize the effectiveness of your financial compliance management efforts, look for software that integrates seamlessly with other systems used in your organization, such as customer relationship management (CRM), enterprise risk management (ERM), and business intelligence (BI) tools. This integration will provide a holistic view of your compliance posture and enable better decision-making, enhancing the interoperability of financial compliance software for financial services.

7. Evaluate User Experience and Support

The success of your financial compliance software implementation depends on user adoption and satisfaction. Choose a platform with an intuitive interface that is easy to navigate and understand. Additionally, consider the vendor’s customer support offerings, including training, documentation, and ongoing assistance to ensure a smooth implementation and long-term success, fostering a positive user experience in financial compliance management software for financial services.

8. Leverage Advanced Analytics and Reporting

Financial services firms need to stay ahead of compliance risks and opportunities. Look for financial compliance software that offers advanced analytics and reporting capabilities, enabling you to identify trends, detect anomalies, and make data-driven decisions. The platform should provide real-time insights into your compliance posture, risk exposure, and regulatory obligations, empowering you to proactively manage compliance and drive business growth.

9. Ensure Continuous Monitoring and Auditing

Compliance is an ongoing process that requires continuous monitoring and auditing. Choose a financial compliance software that offers real-time monitoring of regulatory changes, compliance status, and risk indicators. The platform should also provide automated auditing and reporting capabilities, ensuring that you are always prepared for regulatory exams and audits, and minimizing the risk of non-compliance.

Need help choosing the right tool for your financial institution? Speak with a compliance tech expert and get personalized guidance.

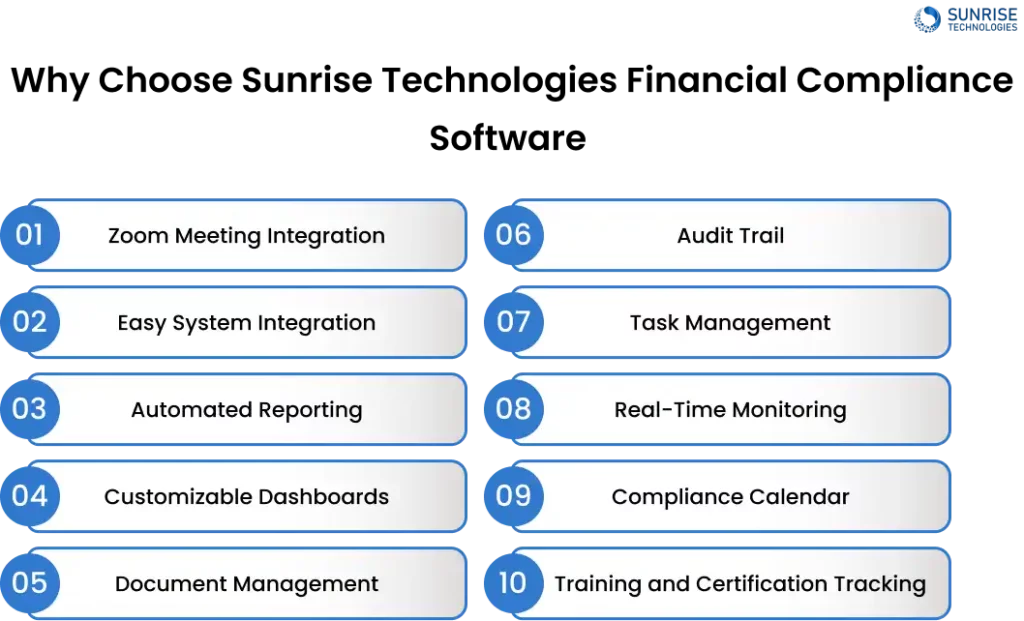

Why Choose Sunrise Technologies Financial Compliance Software?

Sunrise Technologies offers a comprehensive financial compliance software solution designed to streamline regulatory processes and ensure adherence to industry standards. Here are the top features that make Sunrise Technologies stand out in the realm of financial compliance software:

- Zoom Meeting Integration: Sunrise Technologies' software seamlessly integrates with Zoom Meetings, enabling virtual compliance training sessions and meetings for remote teams. This feature enhances collaboration and accessibility, allowing for effective communication and training regardless of location, fostering a connected compliance environment.

- Easy System Integration: The software effortlessly integrates with existing systems, ensuring a smooth transition and minimal disruption to daily operations. This seamless integration enhances operational efficiency, streamlines processes, and reduces the complexity of adopting new compliance management software, promoting a hassle-free implementation experience for organizations.

- Automated Reporting: Generate automated compliance reports to track and monitor regulatory activities efficiently. This feature saves time, reduces manual errors, and provides real-time insights into compliance status, enabling proactive decision-making and ensuring regulatory adherence with ease and accuracy.

- Customizable Dashboards: Tailor dashboards to display key compliance metrics and insights relevant to your organization's specific needs. Customizable dashboards offer a personalized view of compliance data, empowering users to focus on critical information, make informed decisions, and drive compliance initiatives effectively based on their unique requirements.

- Document Management: Centralize and manage compliance-related documents in a secure and organized manner. Efficient document management ensures easy access, version control, and compliance with document retention policies, enhancing data security, facilitating audits, and promoting regulatory compliance within the organization.

- Audit Trail: Maintain a detailed audit trail to track changes and ensure transparency in compliance processes. An audit trail feature provides a comprehensive record of compliance activities, changes, and approvals, enhancing accountability, facilitating regulatory audits, and demonstrating a commitment to compliance integrity and transparency within the organization.

- Enhanced Data Security: Cloud-based systems employ advanced encryption methods and adhere to strict compliance regulations to ensure the security and privacy of your clinic's data. This includes measures such as data encryption, access controls, regular security audits, and compliance with industry standards like HIPAA, safeguarding sensitive patient information from unauthorized access or breaches.

- Task Management: Assign and track compliance tasks to team members, ensuring accountability and timely completion. Task management functionality streamlines workflow processes, improves task allocation, and enhances team collaboration, leading to efficient task execution, compliance monitoring, and overall compliance management effectiveness within the organization.

- Real-time Monitoring: Monitor compliance activities in real-time to address issues promptly and proactively. Real-time monitoring capabilities enable organizations to detect compliance deviations, identify potential risks, and take immediate corrective actions, ensuring continuous compliance oversight, risk mitigation, and regulatory alignment in a dynamic and evolving regulatory landscape.

- Compliance Calendar: Stay on top of compliance deadlines and requirements with a user-friendly compliance calendar feature. The compliance calendar functionality provides a visual representation of compliance deadlines, tasks, and milestones, helping organizations prioritize activities, plan effectively, and meet regulatory obligations on time, reducing compliance-related risks and ensuring regulatory compliance consistency.

- Training and Certification Tracking: Track employee training and certifications to ensure compliance with industry regulations and standards. Training and certification tracking features enable organizations to monitor employee compliance training progress, certifications, and competency levels, ensuring regulatory compliance, competency development, and a culture of continuous learning and compliance excellence within the organization.

By choosing Sunrise Technologies’ Financial Compliance Software, organizations can benefit from a user-friendly and feature-rich solution that simplifies compliance management, enhances operational efficiency, and ensures regulatory adherence without complexity.

Experience how top financial teams simplify compliance. Book a free demo and explore automation, audit trails, and risk alerts in real time.

In conclusion, selecting the right financial compliance software is crucial for organizations to effectively manage regulatory requirements, mitigate risks, and ensure operational efficiency. By utilizing these key features, businesses can streamline compliance operations, maintain regulatory adherence, and foster a culture of compliance excellence within their organization.

Sam is a chartered professional engineer with over 15 years of extensive experience in the software technology space. Over the years, Sam has held the position of Chief Technology Consultant for tech companies both in Australia and abroad before establishing his own software consulting firm in Sydney, Australia. In his current role, he manages a large team of developers and engineers across Australia and internationally, dedicated to delivering the best in software technology.

Cloud Based Project Management Platform

Read the challenges we faced and how we helped

View Case Study